A risk is the chance or odds that an investor is going to lose money, and a return is a gain made by an investor. Beta gives investors additional insight when they do further analysis and ask, “Is there a reason why a particular stock is underperforming or outperforming? A beta calculation shows how correlated the stock is vs. a benchmark that determines the overall market, usually the Standard & Poor’s 500 Index, or S&P 500. The S&P 500 is a market-capitalization-weighted index of 500 leading publicly traded companies in the United States. Investors consider risk-return tradeoff on individual investments and across portfolios when making investment decisions. First, each investment in a diversified portfolio represents only a small percentage of that portfolio.

To calculate an appropriate risk-return tradeoff, investors must consider many factors, including overall risk tolerance, the potential to replace lost funds, and more. The direct cash flow method is more challenging to perform but offers a more detailed and more insightful analysis. In this method, an analyst will directly adjust future cash flows by applying a certainty factor to them. The certainty factor is an estimate of how likely it is that the cash flows will actually be received. From there, the analyst simply has to discount the cash flows at the time value of money in order to get the net present value of the investment. Warren Buffett is famous for using this approach to valuing companies.

It’s a coin-tossing situation, and the investor should be prepared for both scenarios – profit and loss. A potential investment’s beta is a gauge of the amount of risk the investment will contribute to a portfolio that resembles the market. If the beta ends up being more than one, then that indicates that the stock is more risky, but if it’s less than one, it predicts that it’ll be a smaller risk. When you want to determine excess returns on an investment, use the alpha ratio, which refers to returns earned on an investment above the benchmark return. In other words, it measures excess returns from the benchmark index. The return on an investment is expressed as a percentage and considered a random variable that takes any value within a given range.

The expected return is often founded on previous data and so cannot be guaranteed in the foreseeable future; yet, it frequently establishes acceptable expectations. Exchange rate risk — This type of risk arises from the unpredictability of currency value fluctuations. As a result, it impacts enterprises that conduct foreign exchange operations, such as export and import firms, or firms that do business in a foreign country. To compensate for the hazards, a riskier investment must provide higher profits. The gains are what attract some investors, while the danger deters others.

An asset’s price represents the harmony between its risk of failure and its prospective return in a productive market. The level of volatility, or the gap between true and predicted returns, is used to calculate risk. Returns with a high standard deviation are more volatile and riskier than other investments.

Many are convinced that an economic recession accompanies this bear market. Therefore, many people are in a hurry to sell off their shares when they can still make profits, even if negligible. Consider the example of Jane, who has been investing for many years. Deciding which bonds to invest in by looking at the level of risk and which one will create the best profits. Market risk — Market risk is the byproduct of investors’ overall inclination to follow the market.

What Is Risk-Return Tradeoff?

A gain made by an investor is referred to as a return on their investment. Conversely, the risk signifies the chance or odds that the investor is going to lose money. In the case that an investor chooses to invest in an asset with minimal risk, the possible return then is often modest. In contrast, an investment with a high-risk component has a higher probability of generating larger profits.

However, studying the market thoroughly can help investors make the right decisions. A risk can be defined as the uncertainty related to the investment, market, or company. Investors want profits, and the risks can potentially reduce the profits, sometimes even making a loss for them. Various components cause the variability in expected returns, which are known as elements of risk. There are broadly two groups of elements classified as systematic risk and unsystematic risk.

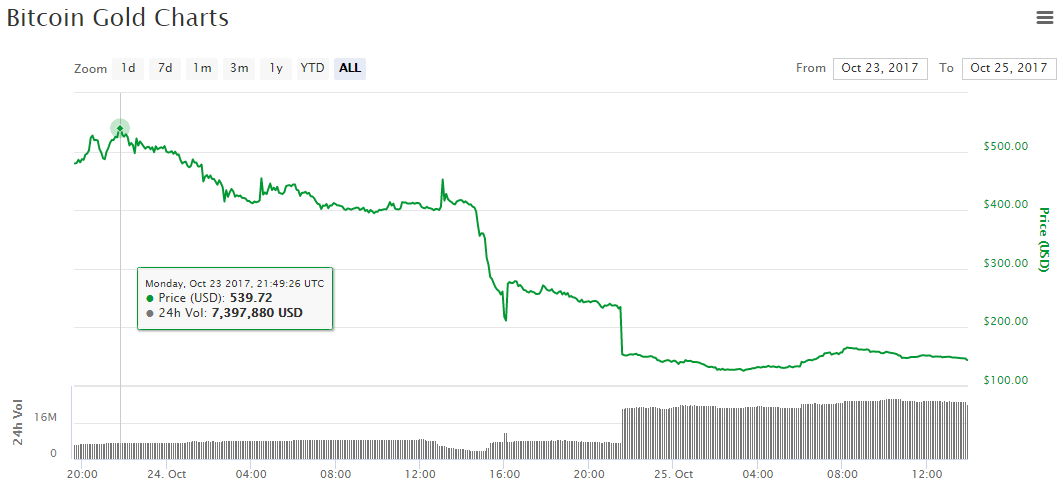

A risk is the chance or odds that an investor is going to lose money. Alpha (α) , used in finance as a measure of performance, is the excess return of an investment relative to the return of a benchmark index. The Capital Asset Pricing Model helps to calculate investment risk and what return on investment an investor should expect. The calculation for the Sharpe ratio is the adjusted return divided by the level of risk, or its standard deviation. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. Currently, most stock prices are falling, especially in the United States.

- Warren Buffett is famous for using this approach to valuing companies.

- To learn more, check out CFI’s guide to Weighted Average Cost of Capital and the DCF modeling guide.

- First, each investment in a diversified portfolio represents only a small percentage of that portfolio.

- Investors can choose multiple investments that offer different returns accordingly.

Time also plays an essential role in determining a portfolio with the appropriate levels of risk and reward. According to risk-return tradeoff, invested money can render higher profits only if the investor is willing to accept a higher possibility of losses. Increased potential returns on investment usually go hand-in-hand with increased risk.

Various changes occur in a society like economic, political and social systems that have influence on the performance of companies and thereby on their expected returns. Hence the impact of these changes is system-wide and the portion of total variability in returns caused by such across the board factors is referred to as systematic risk. These risks are further subdivided into interest rate risk, market risk, and purchasing power risk. The appropriate risk-return tradeoff depends on a variety of factors, including an investor’s risk tolerance, the investor’s years to retirement, and the potential to replace lost funds.

Do investments with higher risks yield better returns?

Investopedia does not include all offers available in the marketplace. If a stock has a beta of -1%, it is inversely correlated—in other words, it has a contrary relationship—to the S&P 500. If a stock has a beta of 1%, it is highly correlated to the S&P 500. If a mutual fund has outperformed by 1%, it will have an alpha of +1.0. Gordon Scott has been an active investor and technical analyst or 20+ years. The Structured Query Language comprises several different data types that allow it to store different types of information…

Regression or proxy model for risk looks for firm characteristics, such as size, that have been correlated with high returns in the past and uses them to measure market risk. After investing money in a project a firm wants to get some outcomes from the project. The outcomes or the benefits that the investment generates are called returns. Wealth maximization approach is based on the concept of future value of expected cash flows from a prospective project. Unsystematic risk is a type of risk that impacts only one sector or one business. It is the danger of losing money on an investment because of a business or sector-specific hazard.

Company

Dispersion is a measure used to predict the range of possible returns for an asset. To calculate beta, divide the variance by the co-variance (which is the measure of a stock’s return relative to that of the market). If a mutual fund has underperformed by 1% against its benchmark, it will have an alpha of -1.0.

Therefore, selecting a high-risk investment can give higher profits, while a low-risk investment will minimize the returns. The underlying principle is that high-risk investments give better returns to investors and vice-versa. When an investment works effectively, risk and return ought to be highly correlated. The larger the risk of an investment, the higher the possible reward. An extremely safe (low-risk) investment, on the other hand, should typically provide smaller returns.

Examples

If a stock has a beta of zero, it is not very correlated to the S&P 500. Below, we will look at two different methods of adjusting for uncertainty that is both a function of time.

A shift in leadership, a safety recall on a good, a legislative reform that might reduce firm sales, or a new rival in the market are all examples of unsystematic risk. Examples of high-risk, high-return investments include options, penny stocks, and leveraged exchange-traded funds . Generally speaking, a diversified portfolio reduces the risks presented by individual investment positions. In finance, risk is the probability that actual results will differ from expected results. In the Capital Asset Pricing Model , risk is defined as the volatility of returns. The concept of “risk and return” is that riskier assets should have higher expected returns to compensate investors for the higher volatility and increased risk.

In any case, returns are often displayed as a percentage of the initial investment. To calculate risk-reward ratio, take the expected return on the trade and divide by the amount of capital risked. This concept is necessary to optimize returns, rather than just investing randomly. This is because the main objective of investors is to make profits. Risk and ROI are the two important factors that affect profits, hence the importance of the concept. Nevertheless, high-risk investments don’t always generate higher revenue.

Investors use risk-return tradeoff as one of the essential components of each investment decision, as well as to assess their portfolios as a whole. According to risk-return tradeoff, invested money can render higher profits only if the investor will accept a higher possibility of losses. Diversification is a method of reducing unsystematic risk by investing in a number of different assets. The concept is that if one investment goes through a specific incident that causes it to underperform, the other investments will balance it out. Many types of risk are involved in investments – market-specific, speculative, industrial, volatility, inflation, etc.