Content

- Grown your business with Envoice

- The Impact of Artificial Intelligence on Accounting

- How COVID-19 changed technology in accounting (and what the future looks like)

- The Uber for Bookkeeping is inevitable

- What are the most common misconceptions about bookkeeping?

- Start Cold Pitching or Applying to Jobs

- Work & Jobs

Manufacturing jobs in general have been shrinking, though the past year has seen a turnaround. The number of U.S. factory workers grew by 3.5% from June 2017 through June 2019, according to BLS data. Since the displaced human assemblers already have some electrical skills, a smart next step in their careers might be to become electricians.

58% of respondents felt that AI would help their firms improve in the future. Intelligent technology has the ability to max out efficiency and create unparalleled insights. This is shaping the world of accounting every day, and the role of accountants stands to change. Every sector, from established accounting firms to innovative fintech companies, is finding opportunities in technology. Far from replacing all accounting jobs or presenting major threats to the industry, AI has the power to transform accounting, for the better.

Grown your business with Envoice

Often, bookkeepers can help manage funds by paying invoices and remitting taxes by their due dates to avoid any annoying penalties and fines. Many times, a good bookkeeper will be your lifeline in case of an audit or tax inquiry. It is important for you to see where money has come and gone from your business dealings. They categorize transactions so the basic financial statements can be produced and give you a clear picture of where the business stands financially. While AI-powered tools could impact the day-to-day, it’s these big picture moments where CMAs really have an opportunity to shine by driving meaningful change in an organization or firm. It is also very likely that these changes will transform your processes and habits at work.

Spend your days organizing the numbers, creating data for clients, and solving problems for them. It can be so freeing to set your own prices for packages you offer to clients. Compare rates to other bookkeepers to ensure you are not pricing your services too low.

The Impact of Artificial Intelligence on Accounting

Or, maybe it is because the major changes we’re seeing are a direct or indirect result of technology. While us guys over at Prospect Financial Solutions haven’t implemented most of those technologies, we recognize this seemingly inevitable shift from humans to AI. And the biggest technological development that we’ve seen as accountants in the last decade has been the emergence of the cloud. According to a Robert Half survey, 71% of managers in the U.S. are either already using some kind of virtual reality or planning to integrate it within three to five years. Yet, the events between then and now, including the Covid-19 pandemic, have instead shown that accountants, like other professionals, need to worry much more about adaptation than replacement.

One is if above trends will grow above the productivity growth i.e. even today there are people handling these transactions. Second is if there’ll be a need for even further specialization of accountants. In large accountancy firms, the traditional pay structure means that individuals earn a comparatively depressed salary until they reach Partner level. The average time it takes for an accountant to become a Partner is around fifteen years.

How COVID-19 changed technology in accounting (and what the future looks like)

So, even young accountants are likely to get a job even if it is not specifically an accounting job. About 135,000 annual jobs openings in the coming years are expected by BLS. At the same time, about 200,000 accounting students graduate each year. That number may lead to some oversaturation which will be offset by the annual retirement of older accountants. All types of organizations from private to public, from non-profit to government require financial operations. All sole proprietors, partnerships, and corporations must keep financial records either for taxation or for their business purposes.

Should I become a bookkeeper?

Bookkeeping is a great starting point if you are interested in the field but not fully committed and want to test the waters. You may also be an ideal bookkeeping candidate if you want a good job with a respectable wage and decent security but may not be looking for a long-term career.

There is a variety of programs available to help bookkeepers with their daily tasks. Understand the popular tasks businesses tend to need completed and familiarize yourself with them. According to Glassdoor, the average base pay for a bookkeeper is roughly $46,000 per year. As you gain more experience, this can easily increase with time. Some bookkeepers can even make this base salary working part-time. Depending on the company you work with or the clients you attract, certification is not typically required.

The Uber for Bookkeeping is inevitable

For instance, if you’re not already using a cloud-based accounting software program, now is to start. Cloud-based accounting software programs are becoming more popular because they offer many benefits. For instance, technology like OCR is taking over data entry tasks. Machines are being trained on what information to pick and what to disregard. In the process, AI-driven programs can handle large data sets in a heartbeat. The accounting field is pretty diverse, and there are many different types of jobs out there.

An example is Zeni, a start-up that raised $13.5 million to automate bookkeeping using AI. They term their AI-powered solution a “financial concierge” and aim to serve start-ups or other business models with lean resources. This can present a cost-saving measure, reducing the number of bookkeeper hours a company has to pay for. While this may look like a precise example of how AI can replace bookkeepers, that is hardly the end of the story.

What are the most common misconceptions about bookkeeping?

To find out more about becoming a Quantico Financial Business partner, visit our site today. We see the frustration of accountants having to wait 15 years before they feel they are receiving the rewards of their hard work. However, as a Financial Controller, you will also be working to reach the level above, Chief Financial Officer (CFO). A company’s CFO is responsible for supporting the CEO and reporting to the board.

My main goal at Maersk is to create a world-class finance function not least when it comes to Business Partnering. I am the co-author of the book “Skab Værdi Som Finansiel Forretningspartner” and a long-time Finance Blogger with 23.000+ followers. This leaves us with growth in the more complex areas of Accounting being the one that deals with new regulations, complex transactions and transactions across borders. If you’re a talented accountant looking for an exciting new challenge, it’s time to talk to Quantico.

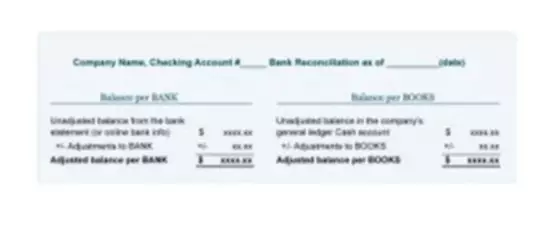

If you have a larger business or complex financial transactions, you may need to meet with your bookkeeper more frequently, such as weekly or bi-weekly. They focus on interpreting financial data and use this information to provide insight into the financial health of a business. Depending on the size of the organization, bookkeepers may also process payroll, handle all business invoicing and collections and pay all invoices. A bookkeeper categorizes each transaction and reconciles the accounting software to the bank account at the end of every month to check for discrepancies. Bookkeeping should take place all year long; not just a year-end or when the tax return is due. ” They should be bugging you for receipts and asking questions about transactions so they can record it to the right line of accounting in the correct period.

Firms continue to struggle with talent acquisition and retention — Accounting Today

Firms continue to struggle with talent acquisition and retention.

Posted: Fri, 19 Aug 2022 07:00:00 GMT []